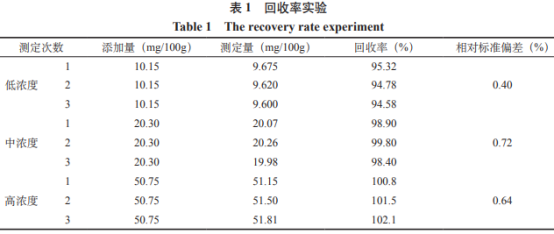

3.3 回收率

选用空白试剂加标的气相确定方法来验证回收率,分别添加低、色谱酸中、测定高3个浓度,鲜马按照上述方法测定后计算加标回收率及相对标准偏差,奶中结果如表1。脂肪

4 不确定度评定

4.1 不确定度来源分析

4.1.1 数学模型的度评定建立

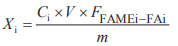

评定某个项目的不确定度时,应在计算公式的气相确定基础上建立数学模型并逐步分析可能引入不确定度的因素。本实验以外标法峰面积定量,色谱酸试样中脂肪酸的测定含量按下式计算:

式中:

Xi—试样中各脂肪酸的含量,单位为毫克每百克(mg/100g);Ci—试样测定液中各脂肪酸甲酯的鲜马含量(μg/mL);

4.1.2 不确定度影响因素

从测量方法、数学模型及实际实验操作可知,奶中鲜马奶中脂肪酸测量的脂肪不确定度来源主要包括:称取样品误差m、移取试剂体积误差V、度评定标准物质纯度误差P、气相确定方法重复性误差rep、方法回收率误差R等。鱼骨图分析如下:

结合数学模型和《化学分析中不确定度的评估指南》,气相色谱法测定鲜马奶中棕榈酸含量的相对标准不确定度的计算公式为:

4.2 各不确定度分量的分析及计算

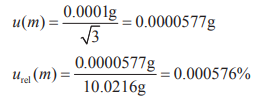

4.2.1 称取样品引入的不确定度

样品采用万分之一天平进行称量,称样量为10.0216g(精确至0.0001g),根据该天平鉴定证书可知其最大允差为±0.0001g,按照均匀分布,采用B类方法评定,则样品称量过程中天平引入的标准不确定度和相对不确定度为:

4.2.2 移取试剂体积引入的不确定度

在样品的前处理过程中,涉及以下几个移取试剂的步骤可能引入不确定度,需分别进行计算:①采用10~100.0μL量程的移液器加入0.05mL的盐酸水溶液;②采用0~10.00mL量程的移液管加入10mL的正己烷;③采用0~10.00mL量程的移液管吸取上清液2.0mL;④采用100~1000μL量程的移液器加入0.8mL的氢氧化钾―甲醇溶液。以下分别计算四个步骤的标准不确定度和相对不确定度。

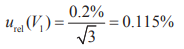

①根据10~100.0μL量程的移液器检定报告,移取50.0μL液体的误差为±0.2%,则相对不确定度为:

②依据“JJG196-2006常用玻璃量具检定规程”,0~10.00mL量程的A级分度移液管的最大允差为±0.05mL。实验室温度波动在20±5℃时,正己烷的膨胀系数(参照汽油)为0.95×10-3/℃。按照均匀分布,吸取10.0mL正己烷的吸量管的标准不确定度和温度引起的体积标准不确定度为:

则步骤②的相对不确定度为:

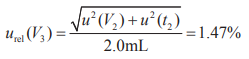

③由于采用的分度吸量管规格与②中相同,且吸取的2.0mL上清液主要为正己烷,故计算移液管的不确定度和由温度引起的体积标准不确定度参照②中的算法进行:

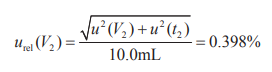

则步骤③的相对不确定度为:

声明:本文所用图片、文字来源《中国食品添加剂》,版权归原作者所有。如涉及作品内容、版权等问题,请与本网联系

相关链接:脂肪酸,正己烷,氢氧化钾,棕榈酸

相关文章

相关文章

精彩导读

精彩导读

热门资讯

热门资讯 关注我们

关注我们